|

DOB MARKET MAKING SYSTEMThe DOB Market Making System is a powerful trading software. It is the result of continuous evolution of the trading algorithms, GUI and performance, according to the traders requirements during many years. DoB System runs on all modern versions of MS Windows. HIGH PRODUCTIVITYDoB System key characteristics are as follows:

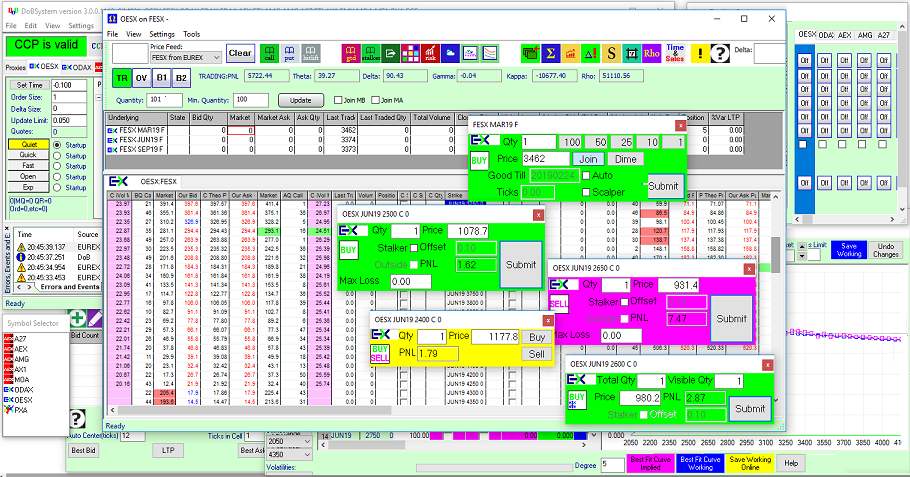

The picture below shows the example of trader's desktop during usage of DoB System. The trading system allows to trade simultaneously on several exchanges, like Eurex, XETRA and Euronext. Up to 50 Options products together with their Underlyings can be traded in the single instance of DoB System. Each Option can have up to six Underlying products.

QUOTE ENGINEAs a trading tool for Market Makers the DoB System provides various algorithms for quotes, Mass Quotes and Strategy quotes for Eurex and Euronext. Among other features, the system gives to the user:

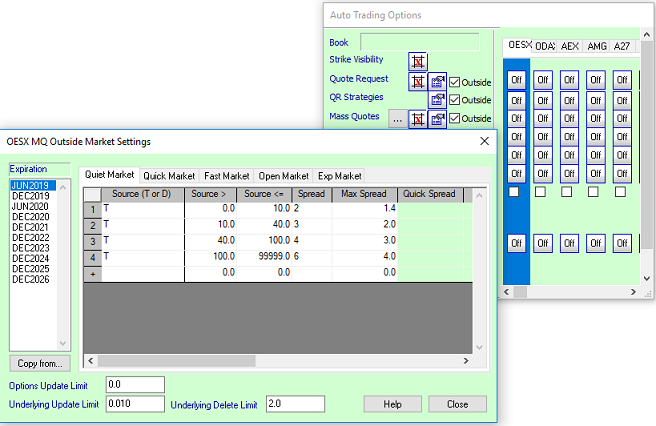

The following picture shows the example of the settings for Mass Quotes. Depending on the range of theoretical prices, the system automatically selects the spread for the quoting, according to the Max. Spread settings. The settings are individual per expiration month. The settings are also individual per market state: quiet, quick, fast, open market and market on expiration:

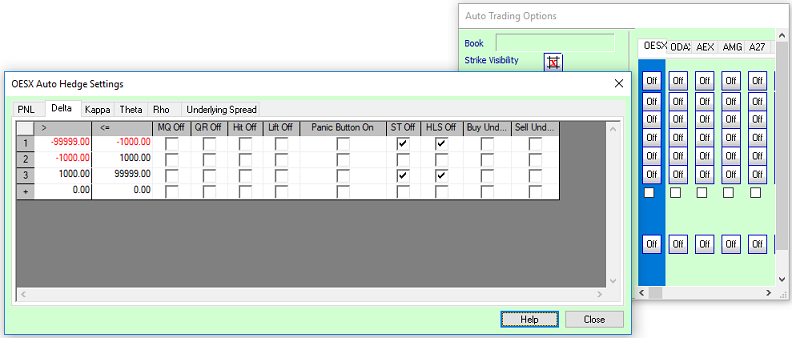

The next picture demonstrates the sample of Auto-Hedge settings. Depending on the range of Delta (or any other Greek), the system can perform several of predefined acrtions: switch off automatic Mass Quotes algorithm, switch off Quote Request or Hit Lift algorithms, remove all orders and quotes from the market by automatically pressed Panic button, and so on:

Auto-Hedge settings are individual per Option product. AUTOMATIC TRADING ALGORITHMSThe DoB System implements the set of predefined automatic trading algorithms. They include:

BUILT-IN RISK MANAGEMENTThe DoB System provides various windows for online calculation of the Risk and Greeks.The main of them are:

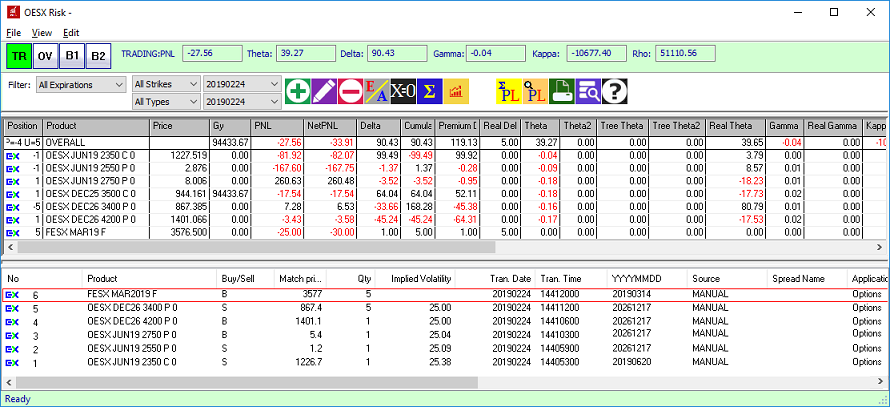

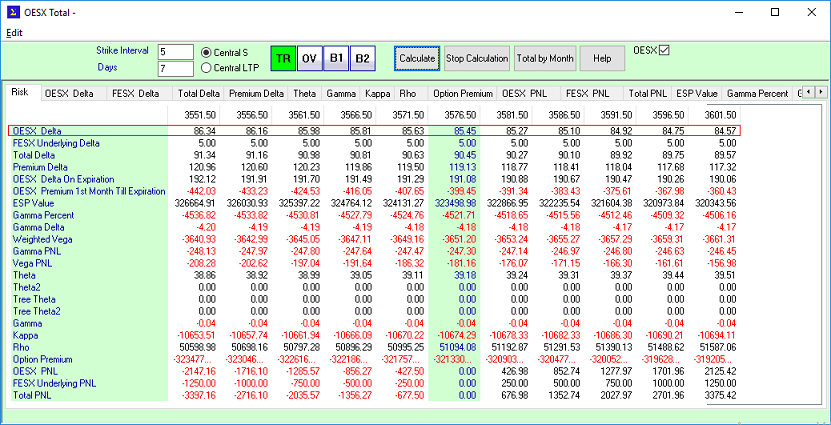

The window below demonstrates the Risk window for individual Option product OESX and it Underlying product FESX. The window consists of two panes. The upper pane shows the P&L and Greeks per Strike. The lower pane contains the list of trade confirmations for the selected date (today by default).

The toolbar of this Risk window allows to perform the filtering of the trade confirmations by expiration date, strike, Call or Put or Future. There are buttons for Exercise/Assignment, for opening of P&L Summary, P&L Position windows, and so on. Another example is the Total window shown below. It contains the Risk and Greek values for Underlying price change from current value to 5 values up and 5 values down. Corresponding underlying prices are displayed in the column header:

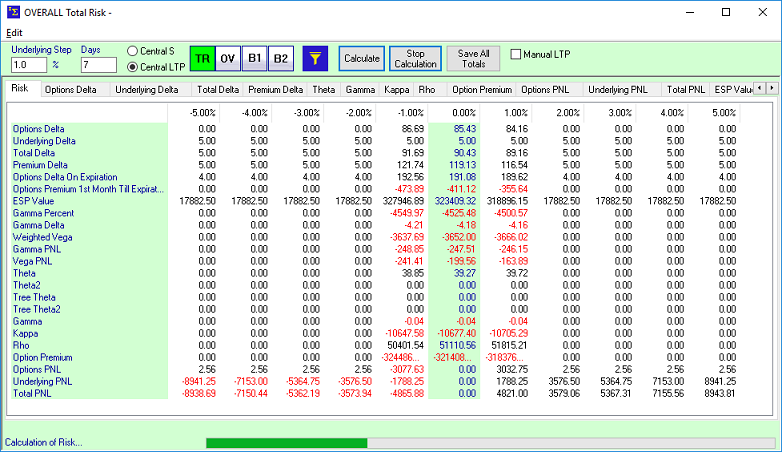

One more example shows the Total Risk window for all products in the DoB System. Since various Option products are using different Underlyings, the "what if" scenario is based on change of the price in percents. The column header of the window shows P&L and Greek values for situations when Underlying price is up or down by given number of percents:

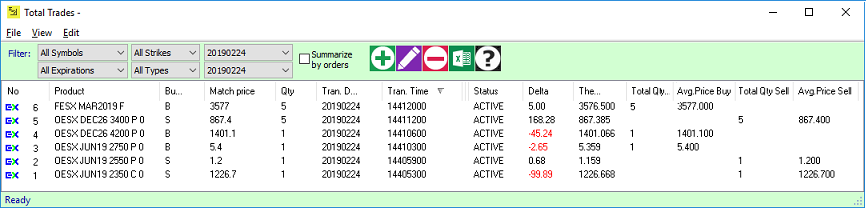

Another example is the Total Trades window shown in the next picture:

This window containts the list of trade confirmations for given date, with filtering by selected Symbol, Expiration, Strike, Call or Put or Future or Stock. The trade confirmations can be summarized by orders. VOLATILITY SETTINGSThe DoB System implements flexible management of the Volatility. For this the system has two different ways of online Volatility calculations:

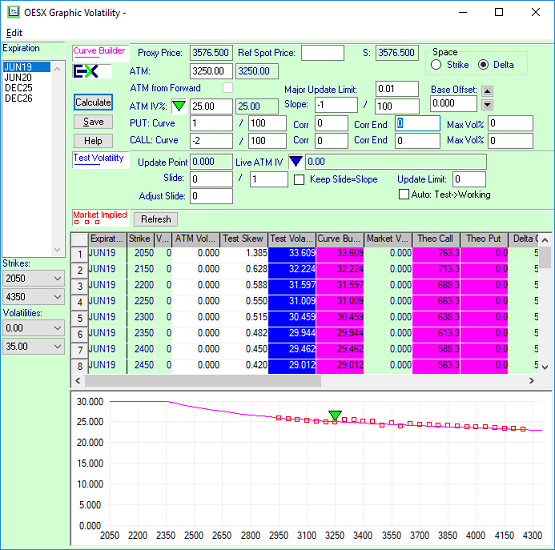

The following picture shows the example of the Curve Builder of Volatlity. The trader can set the coefficients for Call and Put, the slope of the curve, set the sliding parameters. The DoB System will compute new volatility curve at each move of the Underlying price and will use resulting volatilty as input to the fomulas of theoretical prices:

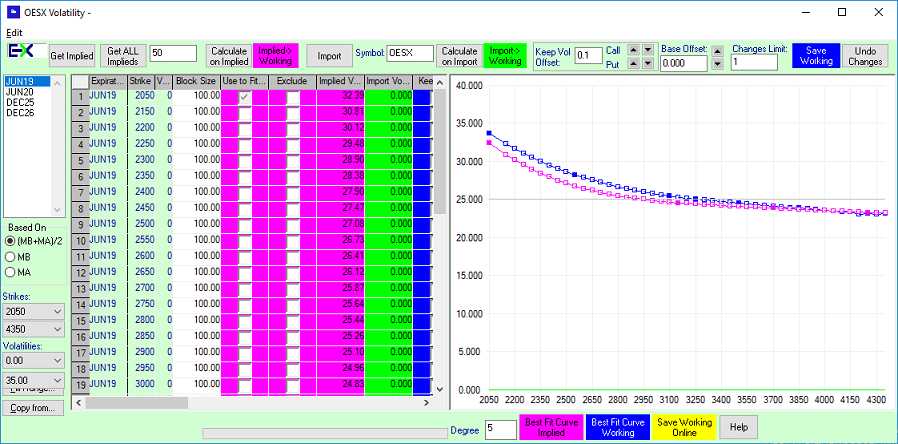

The next picture demonstrates the Implied Volatiltiy window of the system. Using this window the trader can take volatiltiy (pink line) from the market prices and then manually adjust his Working Volatility (blue line). If needed, the Implied Volatility and Working Volatility graphs can be adjusted using polynomial approximation. After that the resulting volatilty is used in the theoretical price formulas. Theoretical prices can be recalculated either all together (with removal of working Mass Quotes) or online, without removal of Mass Quotes. The last option permits to keep the position of the quotes in the exchange priority queue.

If trader wants to make small corrections of the Working Volatility, he can use the tool for online correction of the volatility, as shown below. The system applies such changes without removal of the Mass Quotes or orders from the market.

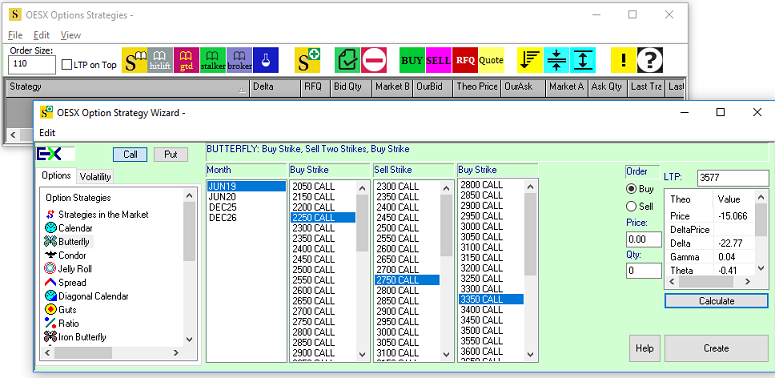

Along with mentioned tools of Volatility controls, the trading software provides functionality for import and export of Volatilities from/to DOB System using own volatility program or 3rd party software. STRATEGIESThe DoB System implements orders and quotes for all Strategies (multi-leg products) supported by Eurex and Euronext. The system has several windows for trading such Strategies. The trader can use Strategies of other participants and can create his own Strategies. Below the window of the Strategy Wizard is shown. The wizard allows to quickly create any Option or Volatility Strategy for any Option symbol with the legs from different expiration months:

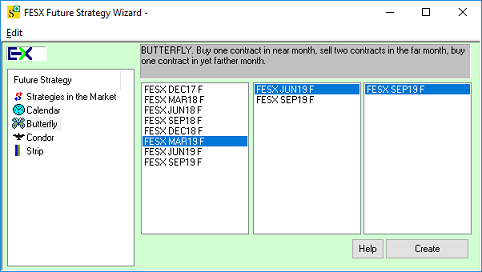

The Strategy Wizard is able to predict the theoretical price of the Strategy together with its Greeks before it is created. Based on the theoretical price, the system can automatically submit Buy or Sell order as soon as Strategy is created in the market. Similarly to the Option Stategies, the DoB System supports all Future Strategies of Eurex and Euronext. The following picture contains the sample of the trading window for Future Strategies together with the order ticket for FESX Spread Strategy:

The Futures Strategy Wizard is similar to Options Strategy Wizard but is simpler, because of small number of the Strategies for the Futures. The trader can quickly create new Strategy or can take the Future Strategy from the market and add it to his trading windows:

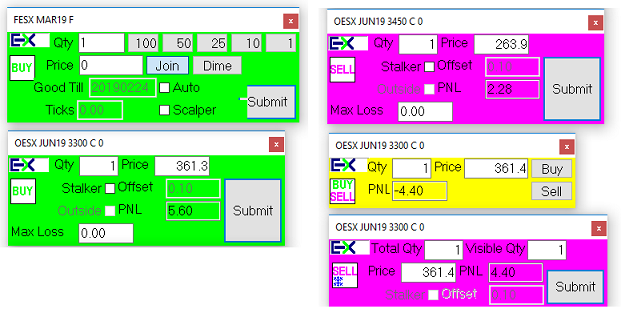

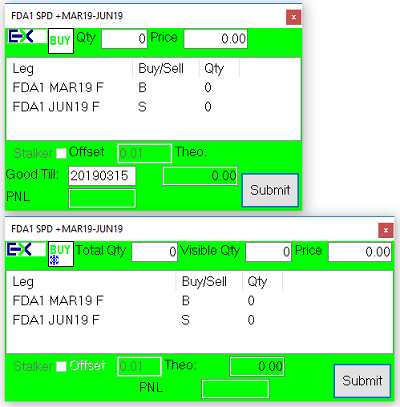

ORDER TICKETSThe DoB System is highly automated trading software. At the same time it gives to trader the convenient functionality for manual trading. The following are the samples of the various order tickets:

The tickets allow to quickly set the price and quantity of the order, to select Buy or Sell side, to calculate what P&L will be in the case the order trades. The trader can add to the order additional attributes like Auto-reflection or Scalper, or Stalker order, or Max Loss. The Strategy orders are similar to the outright orders but in addition contain the list of the legs and the theoretical price:

For trader's convenience the DoB System allows to select the font type and its size for the order tickets and for all the trading windows. Each trading window can have individual colors for its columns.

EXAMPLE OF USAGEThe DoB System can be used for trading not only traditional derivatives but also the currency pairs (options and futures). The video below demonstrates how trader can add the Eurex-provided currency pair to the system, obtain the theoretical prices and submit option and future orders.

|

| © 2026 DSTRADER.NL | Terms of use |