DsTRADER STOCKS, FUTURES AND OPTIONS TRADING SOFTWARE

KEY CHARACTERISTICS

The key characteristics of DsTrader are:

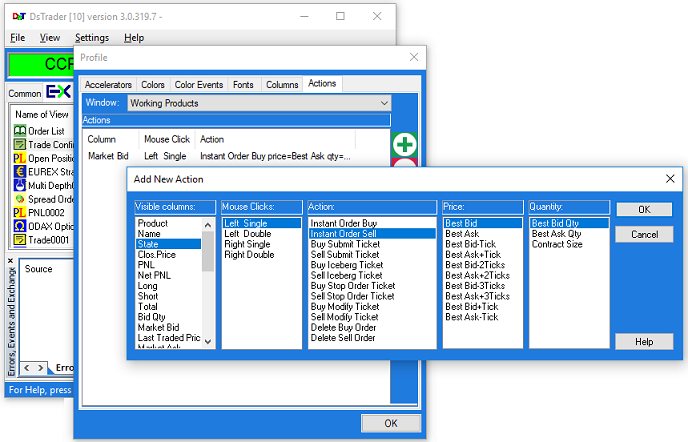

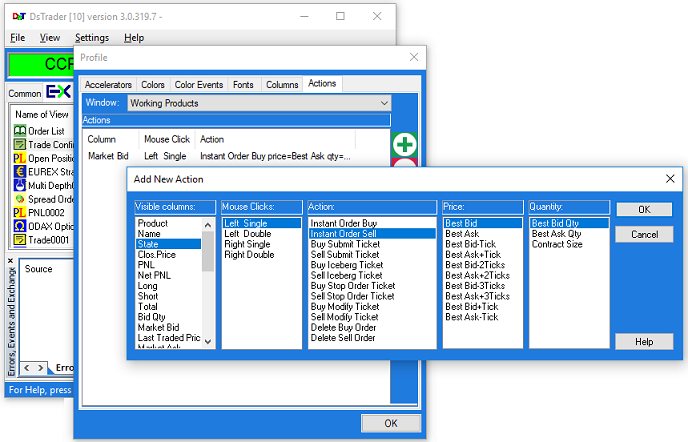

- System is designed for quick manual trading. The trader can assign Mouse Actions for left or right click on any cell of information grids of the system

- Keyboard shortcuts allow to assign the set of predefined actions to any key

- Variety of manual, semi-automatic and fully automatic orders

- Real time Risk and position calculations

- Multiple windows including Custom Views for display of market data

- Trading system is compliant with MiFID II

CONNECTIVITY

The DsTrader is connected to largest European trading venues: Eurex (Futures and Options), XETRA (Stocks), Euronext (Stocks, Futures and Options).

PRODUCTS FOR TRADING

DsTrader covers the following product types: Options (including Weekly and Daily), all types of Stocks and Futures, Option and Future Strategies.

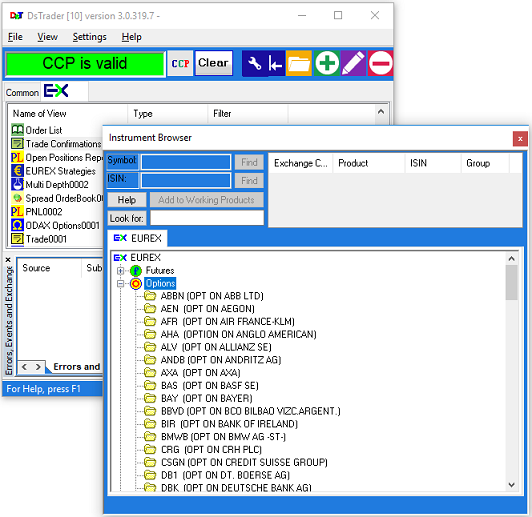

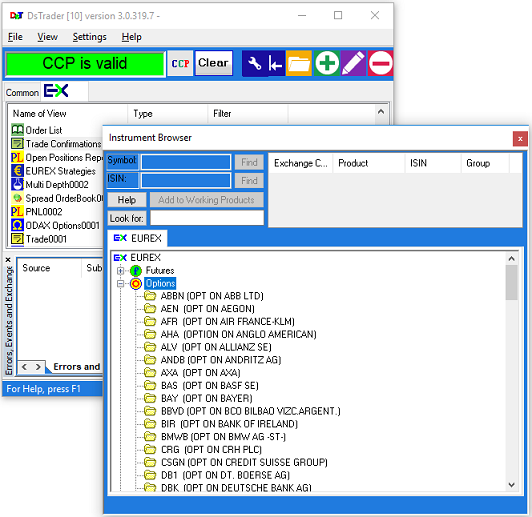

The trader can select products for trading from Instrument Browser window, as shown in the pciture below.

ORDER TYPES

DsTrader supports the following order types, available for connected exchanges:

Manual orders:

- Stock, Option and Future LIMIT, MARKET, STOP-LIMIT, STOP-MARKET orders

- Good Till Date, DAY, Immediate and Cancel, Fill Or Kill

- Iceberg orders

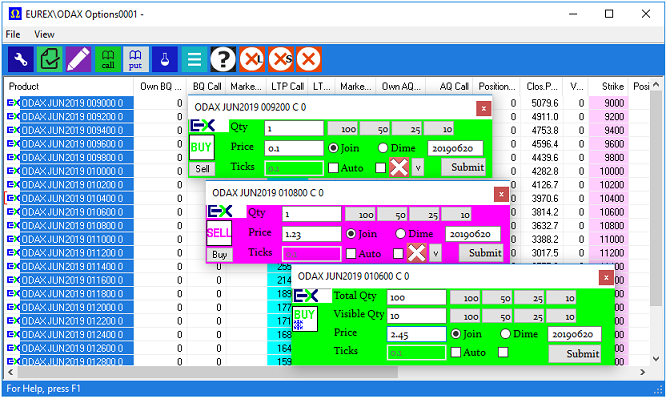

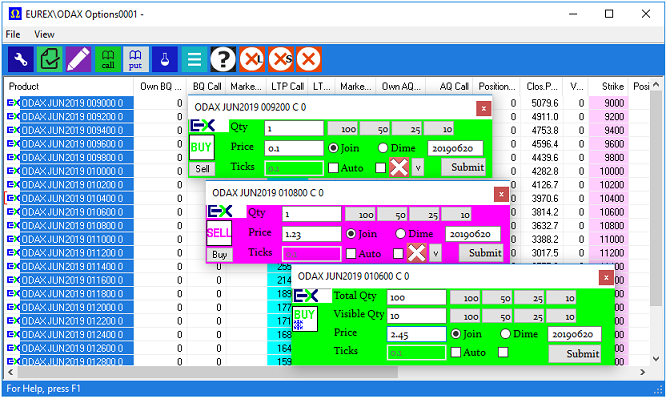

The following picture shows various order tickets for manual orders.

Semi-automatic orders:

- Auto-reflection. As soon as such order trades the system automatically sends an opposite order to the same product with predefined price and quantity.

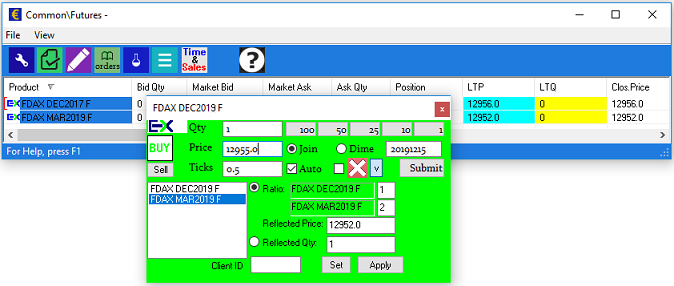

- Auto-reflection to a different product. When such order trades, the opposite order is sent to a different product. For this new order the system uses predefined price and quantity or the ratio of quantities.

- Scalper. This is an auto-reflection order that automatically submits another auto-reflection order as soon as system receives a trade confirmation for such order.

- Trailing Stop order. Trailing Stop-loss orders automatically follow the market and keep track of current position and last traded price. When position changes from long to short (or vice versa) the system changes Trailing Stop order from SELL to BUY (or from BUY to SELL).

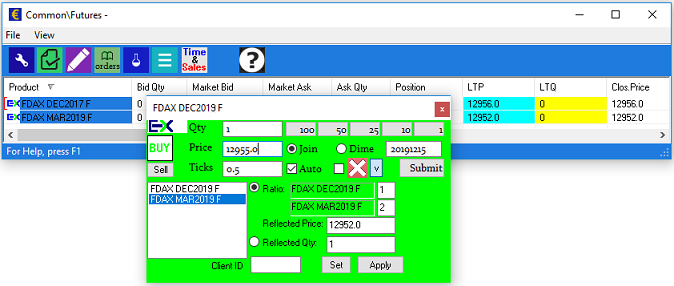

This is an example of the auto-reflection order ticket:

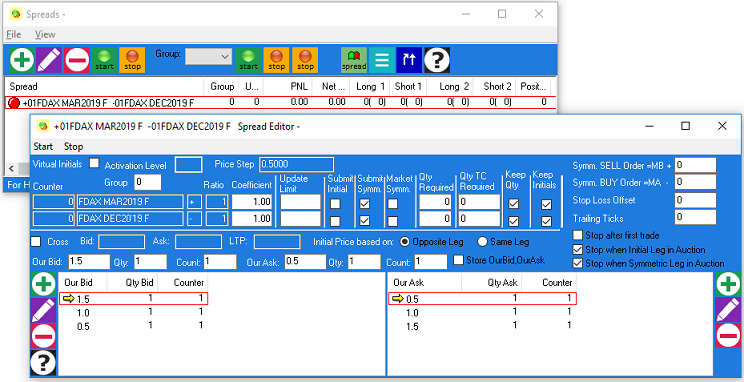

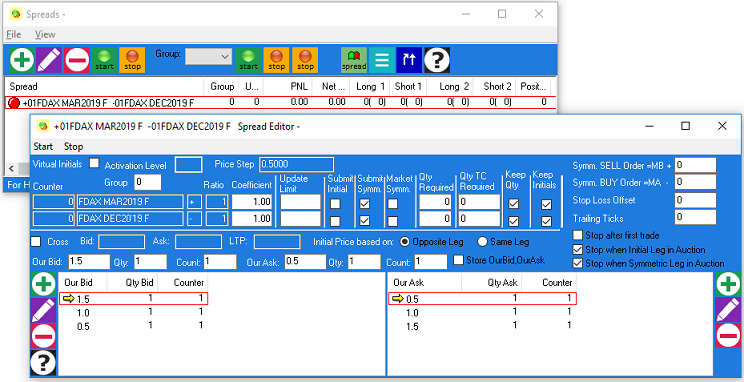

Automatic orders (Automatic Spread Editor algorithm):

- The DsTrader implements automatic algorithm of cross-exchange spreads.

- The trader assigns two products from any exchange as the legs of the Spread.

- Then he defines the offsets for price calculation and the quantities to be traded.

- When Spread Editor is started it automatically routes orders, updates them according to the market movement, handles trade confirmations and keeps positions according to defined ratios.

-

Trader can create any number of Automatic Spread Editors for flexible control of the price and quantities

per leg.

The Spread Editor window contains various settings for efficient trading of the pair of products:

PROFILE OF THE USERS OF THE DsTrader SYSTEM

User 1: Day Trader.

Trades with Euronext Stocks and XETRA Stocks.

Uses following orders : AutoReflection, AutoReflection to another product, Scalpers, Trailing Stops, Icebergs.

User 2. Day Trader.

Opens 5-10 Depth windows in various forms on FTI (Euronext), FDAX, FSMI (Eurex). Uses click-trading mostly.

Submits orders: DAY, AutoReflection, Scalpers.

Additionally, this trader uses "pre-submit in morning" functionality, when he prepares a set of the orders in advance and then submits them all together when he sees a profitable opportunity.

User 3: Position Keeper.

Uses AEX Option (Euronext) front month together with Daily and Weekly Options.

Uses Option orders, Stock orders (Stock Options and Euronext stock order routing).

User 4: Uses Eurex Futures and Options.

For options: Uses ODAX, OESX and OSMI in combination with filter for expiration months trader wants to view.

Uses Future Orders, Options Orders and Stop orders. Good till date orders.

User 5:

Trades Eurex and Euronext Futures and uses 3 Automatic Spreads on FDAX-FESX and FGBL-FGBM (both Eurex, so interexchange spread) and FDAX - FTI (on Eurex and Euronext, so intra exchange spread).

User 6:

Trades Euronext and Xetra stocks mainly. Wants to view and sometimes trade Eurex futures (FESX and FDAX).

Uses 10 market depth views. Trades with 5 of them actively.

Uses several spread Editors between stocks, like ING-AGN (interexchange spread) and ING - DBK (intra exchange spread).

Uses trailing and ordinary stop orders.

User 7:

Uses Eurex, Euronext and trades all kind of Futures.

May also use the 2-3 Spread Editors in parallel.

Uses Trailing stops and stop orders.

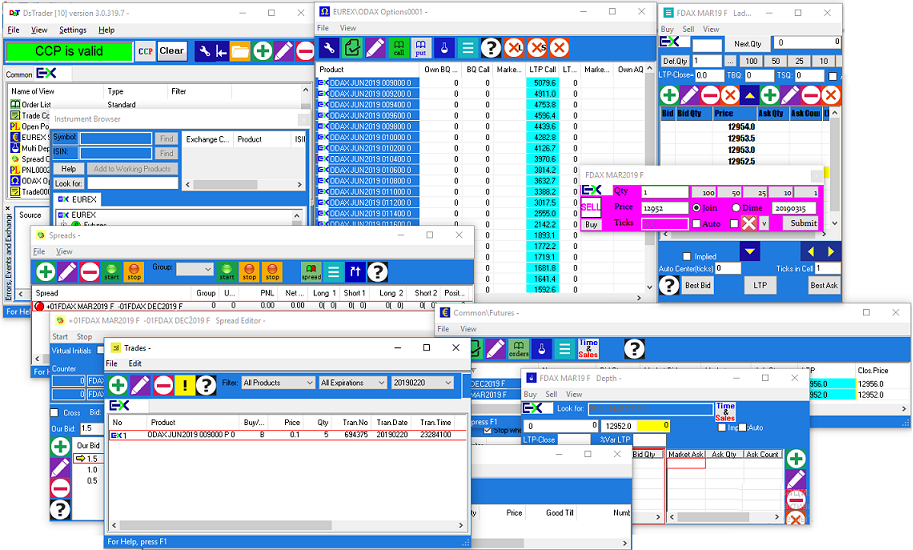

MARKET DATA WINDOWS AND TRADING WINDOWS

The trader can flexibly control the information on the screen.

For this he can create unlimited number of views.

Each view has a custom set of columns and rows the trader wants to display.

The trader can assign to views any font, text color and background color of grid columns.

The system will store his settings together with windows size in position on the screen.

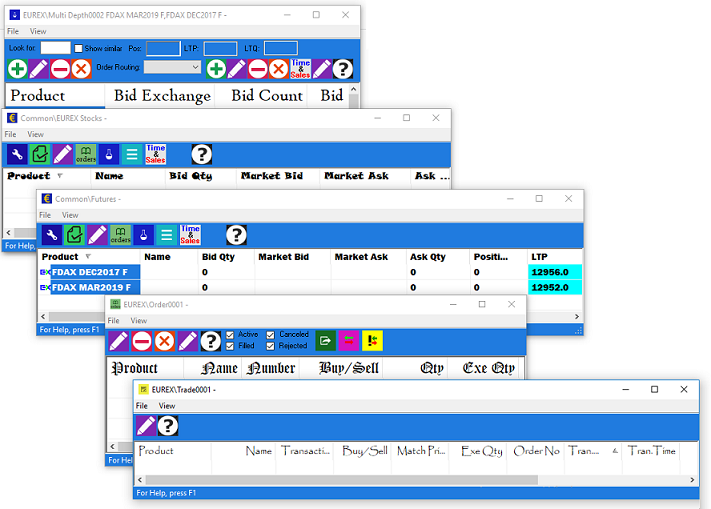

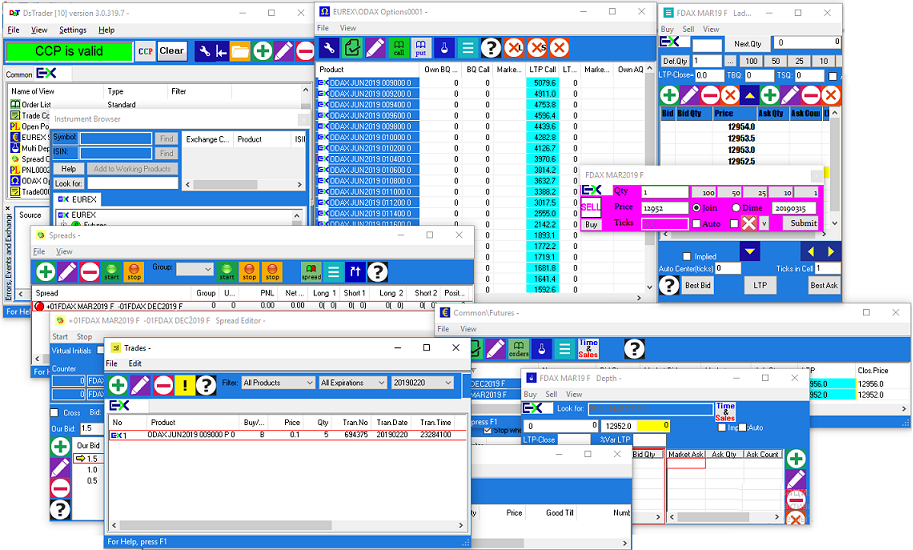

Below the typical trader's desktop of the DsTrader is shown.

Trader can assign Mouse Actions to any cell of the window grids. The actions he defines will give him the opportunity to use for example 1 mouse click for one of following actions: Submit an order, Modify an order, Delete an order, Get a new order ticket up. In fact, all possible mouse actions trader can think of can be added to the system very quickly.

System takes care of real time Profit and Loss and Position updates.

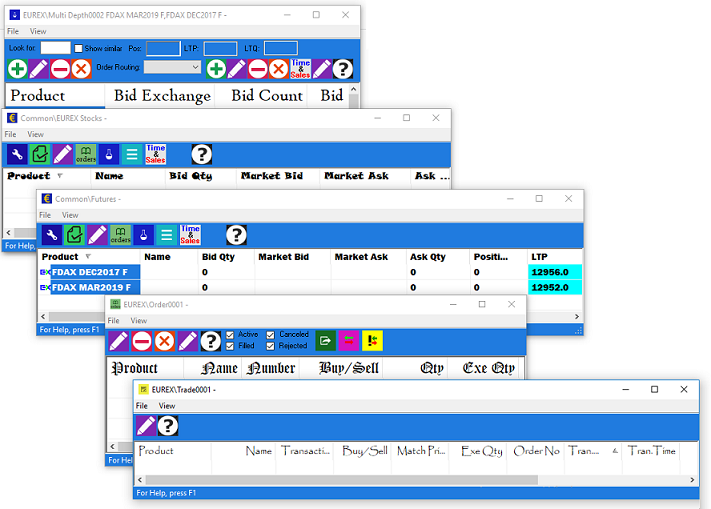

System displays Order List (Order Book), Trades Window, Time and Sales Window, Depth Windows per product.

For Stocks with the same ISIN code the system provides Multi-Product Depth view where market depth data is displayed for several identical products from different Exchanges.

RISK MANAGEMENT

DsTrader runs with a Risk Management system on the background.

In DsRiskManager system the Risk manager can define the maximum position, and Maximum Quantity allowed in the Order Books.

Also, Risk manager can define a limit on every product a Trader adds on in DsTrader.

This is separated into a Quantity Setting for Options, Futures and Stocks.

The Risk manager can always define a new Quantity constraint for a trader, which will be applied instantly.

The trader gets an information popup for this.

The Risk manager controls all orders of all active traders in DsRiskManager Orderbook. He can submit new order on behalf of any trader, can edit or delete any active order.

INFRASTRUCTURE CONFIGURATIONS

The DsTrader infrastructure is allocated in one of the following possible configurations:

- Citrix-based configuration. The DsTrader and DsRiskManager are working in the Data Center of the hosting company. The DsTrader is published on Internet in a Citrix environment.

This configuration uses minimal hardware and software requirements for the client - only a computer with Internet access is needed per trader. No additional servers, no database computer and no IT

managers are required for the trading company.

- Office-based configuration. Servers, database and communication hardware are located in the company office or on leased Data Center computers. The DsTrader and DsRiskManager are running

directly on the computers in the company office. This configuration is designed for companies that have their own Data Center and IT managers.

- Internet configuration. Is similar to the Office configuration but DsTrader can work not only on the office computers but also via Internet. This configuration can be used by companies

that have traders working in the office and in remote location (office in another city or from home).

CUSTOM VIEWS

The trader can flexibly control the information on the screen. For this he can create unlimited number of views. Each view has a custom set

of columns and rows that the trader wants to display.

-

The trader can assign to views any font, text color and background color of grid columns.

The system will store his settings together with windows size in position on the screen.

-

Market Data (price, depth and trading phase) is displayed in various custom views.

-

The custom view of orders allows to control active and filled orders, quickly modify

their parameters, change automatic type of the order.

-

Custom Views for P&L and Positions are dynamically calculated and inform trader about his Risk.

-

The list of intraday and overnight trade confirmations is available in standard or in custom forms.

The following picture contains various Custom views: